Forming long lasting relationships by managing rising healthcare costs through high quality

Frequently Asked Questions About Self-Funded Health Plans

We've researched the most frequently asked questions about self-funded health plans and had these questions answered by insurance professionals. Here are the most common questions people have about self-funded health plans and making the switch. What is a...

Savannah CEO — Angela Wood, Self-Funding 101

Angela Wood, Executive Director of Savannah Business Group, explains what self-funding is and why it may be a smart option for employers. Self-funding gives businesses more control over their healthcare spend, with support from trusted partners like third-party...

Savannah CEO – Angela Wood

Angela Wood, Executive Director of Savannah Business Group, highlights the benefits of joining SBG—a coalition of mid-size and large employers focused on managing healthcare costs through self-funding. Learn how SBG offers cost savings, quality care, and...

Savannah CEO – Candice Ashley

Meet Candice Ashley, Vice President and HR Manager at Thomas and Hutton Engineering, as she shares the vital role of Savannah Business Group’s Executive Committee in shaping healthcare in our community. Discover how local employers are uniting through strategic discussions and effective collaborations to drive better healthcare outcomes and deliver the best for their employees.

Savannah CEO – Angela Wood SHA Grant

Hear from Angela Wood, Executive Director of Savannah Business Group, who shares SBG’s commitment to improving community health through our not-for-profit initiative, Savannah Health Alliance. This organization supports local programs with mini grants focused on childhood obesity and child health.

Savannah CEO – Tami Powers

Tami Powers – Director of Personnel for Vaden Automotive Tami Powers talks about the many benefits of partnering with Savannah Business Group and how they can help your business.

Savannah CEO Angela Wood

Our Executive Director, Angela Wood, discusses SBG's focus on keeping healthcare costs down. For more information about how we engage in group purchasing, visit our website at www.savannahbusinessgroup.com

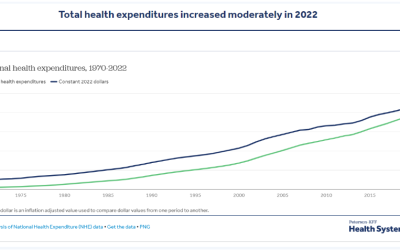

How has U.S. Spending on Healthcare Changed over Time?

This chart collection explores National Health Expenditure (NHE) data from the Centers for Medicare and Medicaid Services (CMS). These data offer insights into changes in health spending over time in the U.S. as well as the driving forces behind spending growth. The...

Addressing Obesity through Holistic Design

Obesity is a complex and multifaceted chronic disease, affecting more than 40% of the US population and linked to more than 220 conditions, including cardiovascular disease, Type II diabetes, and certain cancers. Recognizing that most employers are committed to a...

Addressing Pharmacy Benefit Management Misalignment

High prescription drug costs continue to bankrupt families, put financial strain on businesses, and drag down the US economy and pharmacy benefit management plays a significant behind-the-scenes role. To arm employers and other plan sponsors with a blueprint to...