Employer Excise Tax for PCORI

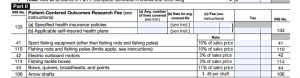

Employers will be submitting the first payment of the PCORI fee on IRS Form 720 – Quarterly Federal Excise Tax. Yes that’s correct; PCORI is right there with fishing rods, arrows, boats, and tanning salons.

It’s time to look at a new way of funding your health care benefits.

First PCORI Fees Due by July 31st for Employers Sponsoring HRAs and Other Self-Insured Plans

The IRS has revised Form 720, Quarterly Federal Excise Tax Return, for employers sponsoring certain self-insured health plans to report and pay new fees imposed under Health Care Reform to fund the Patient-Centered Outcomes Research Institute (PCORI).

Affected Employers PCORI fees are imposed on plan sponsors of applicable self-insured health plans for each plan year ending on or after October 1, 2012, and before October 1, 2019. Applicable self-insured health plans generally include health reimbursement arrangements (HRAs) and health flexible spending arrangements (FSAs) that are not treated as excepted benefits.

Calculating the Fee

The fee for an employer sponsoring an applicable self-insured plan is two dollars (one dollar for plan years ending before October 1, 2013) multiplied by the average number of lives covered under the plan. For plan years ending on or after October 1, 2014, the fee will increase based on increases in the projected per capita amount of National Health Expenditures.

How to Report and Pay the Fee

Form 720 must be filed annually to report and pay the fee no later than July 31st of the calendar year immediately following the last day of the plan year to which the fee applies. Note that the regulations do not permit or include rules for third-party reporting or payment of the PCORI fee. According to a recent IRS memo, employers may deduct PCORI fees as ordinary and necessary business expenses for federal tax purposes.

Consultants

Your search ends here.

Self Funded Employers

Think you have the best plan? Let's find out together.

Still on Traditional

Insurance?

Start saving with self funded plan.